Making Right to Work checks: what happens when they go wrong?

During a webinar with our partners CIPHR – ‘Building a case for electronic Right to Work checks‘ – I gave an overview of current Right to Work legislation and the risks associated with employing illegal workers and shared how our solutions help to speed up Right to Work checks. As part of the webinar, I asked participants how they were currently making checks and what they thought were the biggest risks of getting checks wrong. Read on for a summary of the presentation…

1. What are Right to Work checks?

As you probably know, if you’re employing staff in the UK, you must confirm their immigration status before they start work. This means checking their passport, visa, and/or another immigration document to confirm they have the Right to Work in the UK. To be legally compliant, you must make this check before their first day of employment or on the first day, before they’ve carried out any work. So, if a new-starter doesn’t bring the right documents on day one, or worse still, refuses to bring them for you to check, you shouldn’t allow them to work until you have been able to make the checks. If someone has time-limited permission to work in the UK, this also means carrying out a follow-up check at the right time. And if you’re suspicious that someone doesn’t have the Right to Work in the UK, you shouldn’t employ them until you have confirmed it.

There are many different documents which you can accept as part of a Right to Work check and the Home Office publishes a full list of documents here.

2. How do I make a Right to Work check?

According to Home Office guidance, there are two types of right to work checks; a manual document-based check and an online check. The 3 steps to a manual Right to Work check are:

Obtain: you must see an applicant’s original documents

Check: you must check that the documents are valid, in the presence of the applicant

Copy: you must take a copy of the document for your files and record details of the check (date and who made the check)

For an online check, the applicant first views their own Home Office right to work record and then share this information with you by providing you with a ‘share code’

When surveyed, 98.5% of our webinar attendees told us that they make Right to Work checks manually by visually inspecting an identity document, photocopying and signing it and then filing a paper copy. A thorough manual process may well be sufficient for your business to comply with legislation and if you ensure that documents reasonably refer to their holder, look genuine and give them the necessary work permissions, this will support your statutory excuse.

However, there are other options to support your Right to Work process. For example, among our survey respondents, 7.5% told us that they also refer to an online database (such as PRADO or Edison TD) to compare the images of documents and access their authenticity. 6% have turned to identity verification software to help them make their checks.

This additional level of checking may be appropriate for your business if you’re employing a large number of staff, see documents from many different countries or work in a ‘higher-risk’ sector.

3. What are the risks of employing someone without the Right to Work in the UK?

There are many risks of getting Right to Checks wrong, both financial and commercial.

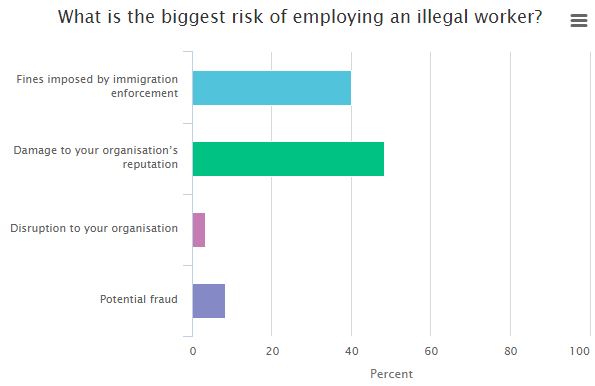

During the same webinar, we asked attendees what they saw as the biggest risk of employing an illegal worker. The results show that the greatest concern is damage to a business’ reputation (48.5%). A negative immigration enforcement visit can indeed damage an organisation’s brand and their trust with customers and supplier. The Home Office publish a quarterly list of fined businesses such as this one and the press regularly report on businesses that have been visited by Immigration Enforcement.

Our participants are also worried about the risk of fines (40% of responses). If your business doesn’t carry out Right to Work checks properly and is found to employ an illegal worker, you could face a civil penalty of up to £20,000 per illegal worker. The Home Office issued fines totally more than £38 million in 2017.

8.5% of participants were worried about fraud. For many of our customers, their counter-fraud teams concentrate on preventing customers from accessing services to which they’re not entitled, such as housing, bank accounts and loans. However, Insider Fraud can also be a risk if you’re employing staff who aren’t who they say they are.

Lastly, our survey participants believe that illegal working can also be disruptive to a business (3.3%). I believe this is due both to the visit from Immigration Enforcement and the associated investigation and due to the need to replace and retrain staff. The Byron Burgers raids in 2016 are reported to have led to ‘very tough trading’ for several months, following negative PR and staffing disruption.

What should I do next?

It is essential that you make everyone who is involved in recruiting staff within your business aware of their duty around Right to Work checks and how to make checks correctly. It’s a good idea to review your contracts / offer letters too and make sure that you mention your requirements for Right to Work checks so that all candidates know what you expect. If you’re unsure of Right to Work regulations or are interested in reducing the time it takes you to make checks, you might also consider reviewing Right to Work technology to help.

Why not watch our full webinar for more details on current Right to Work legislation, the risks of employing illegal workers and how our Right to Work solutions could speed up your Right to Work checks?

Want to find out more?

Our Right to Work service can help you with compliance by making quick, consistent checks on applicants for as little as £3 per check. Why not find out how we could help you?

Sign up to receive updates

Receive notifications from TrustID direct to your inbox. Simply fill out your email address in the form below.

Want to find out more?

We’d be really happy to chat through your requirements and offer advice on the best service for your business.

Tel: 0118 466 0822 or email us.

Request a callback